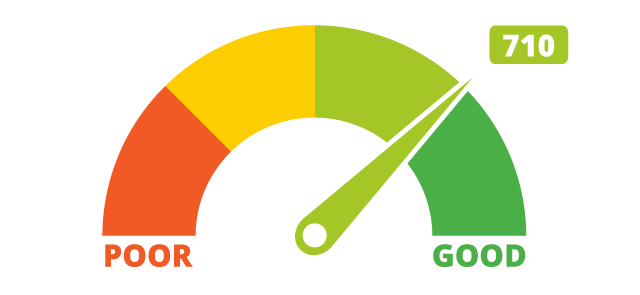

We all know that credit impacts our lives and now more than ever credit plays an important role in the quality of how we live our lives. Whether you are applying for a credit card or purchasing a new car.

Lenders and sometimes employers judge you on your score. Below is a list of 4 ways your credit score can affect your life.

1.) It can raise the price of your bills and expenses-

Having a low credit score can give you a bad impression to your future and current lenders. So you will pay more in interest with higher rates on all of your bills. This in the end can cause you to pay higher fees and waste money on higher interest rates.

2.) Could Keep You From Getting a Good Home or Apartment-

Rental companies and mortgage companies have rules and guidelines for rental or purchases. If you have a score of less than 620, in a lot of cases you will be denied a home loan and even the ability to rent an apartment.

Your score can make you look untrustworthy and a risky person to rent to. So you can find it may be harder for you to rent an apartment or cause you to have to pay a higher down payment.

3.) Determines If Your Loan is Approved-

When you are applying for a car loan, personal loan, bank loan, or even for setting up utility accounts. They run your credit and determine if your score is approvable or not. As mentioned above, if your score is low you may have to pay additional fees or even be denied. Credit scores your risk factor and your past history on managing your debt and payments.

4.) Can Deter You From Getting a Job-

Many companies and employers do a background and a credit check on incoming applicants. So if you have a lot of collections and a bad history of paying your bills on time. This could set you up to lose out on potential job opportunities. An employer bases their first impression on your resume, background and in some cases your credit.

Credit and maintaining a good score is very important to your financial health. People do judge you on your credit whether it is for a loan, job or even an apartment.

Keep your credit in good standing and if you need to improve your score you can reach out to me to help you improve your credit score and your quality of life.